Did you know Bank Five Nine offers a variety of digital banking tools designed to make managing your money easier, faster and more secure? Whether you’re at home or on the go, our banking solutions are here to simplify your financial life. Learn more about these fantastic tools and how you can start using them today.

Key Takeaways

- Monitor Your Credit Score Easily – Stay on top of your credit with free access to your credit score, full credit report, and personalized financial tips.

- Take Control of Your Budget – Use Money Management to track spending, set budgets, and visualize your financial goals all in one place.

- Send and Receive Money Quickly with Zelle – Transfer funds securely in minutes using just an email or mobile number.

- Bank Anytime, Anywhere – Our mobile banking app allows you to check balances, transfer money, pay bills, and more—all from your phone.

- Deposit Checks in a Snap – Skip the trip to the bank and deposit checks instantly using Mobile Check Deposit.

Credit Score: Stay on Top of Your Credit

You can now access your credit score directly within your digital banking! Understand your credit, track changes and get personalized tips to improve it.

With Credit Score, you can:

- View a comprehensive credit score analysis

- Access your complete credit report

- Receive credit monitoring alerts

- Get money-saving offers tailored to you

How to check your credit score:

- Sign on to online banking.

- Navigate to Credit Score.

- Follow the on-screen prompts.

Money Management: Take Control of Your Finances

We’re making it easier than ever to visualize and interact with your money. Money Management provides insights on your spending habits and financial goals.

With Money Management, you can:

- See all your accounts in one place

- View your spending trends

- Set and manage budgets

- Visualize your financial goals

How to get started:

- Sign on to online banking or the mobile app.

- Navigate to Money Management.

- Connect your external accounts.

Learn more about Money Management

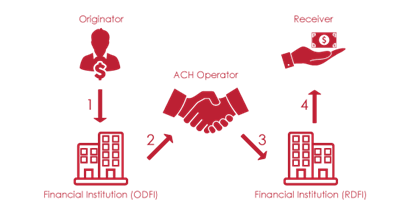

Zelle: Send, Request, or Receive Money in Minutes

Whether you’re splitting the bill, paying a babysitter or reimbursing a friend, Zelle makes it easy to send money securely from your online banking or mobile app.

With Zelle, you can:

- Send money to anyone with a United States bank account using their email or mobile number

- Access money in minutes*

- Receive alerts when a payment is completed

How to send money with Zelle:

- Sign on to online banking or the mobile app.

- Navigate to Zelle.

- Enroll your email or U.S. mobile number.

- Enter the recipient’s email or mobile number and amount to send.

Must have a United States bank account. Transactions typically occur in minutes when the recipient is already enrolled with Zelle.

Mobile Banking: Manage Your Money on the Move

Your phone is always within reach, and so are your finances! Our Bank Five Nine mobile banking app lets you stay connected to your money anytime, anywhere.

With our mobile app, you can:

- View balance and transaction information

- Transfer money between accounts

- Pay and manage bills

- And so much more!

Getting started is easy:

- Download the app from Apple’s App Store or Google Play.

- Sign on with your existing online banking user ID and password.

- Explore and enjoy the convenience of mobile banking!

Learn more about Mobile Banking

Mobile Deposit: Deposit Checks in a Snap

No need to visit a branch—deposit checks anytime, anywhere using your mobile device!

With Mobile Check Deposit, you can:

- Save time by depositing checks digitally

- Get fast access to funds

How to deposit checks:

- Sign on to the mobile app.

- Navigate to Check Deposit.

- Snap a picture of the front and back of your check.

- Confirm the account and amount.

Learn more about Mobile Deposit

Transfers: Move Money with Ease

Need to transfer money between your Bank Five Nine accounts? Our Transfers tool allows you to move funds digitally, anytime.

With Transfers, you can:

- Make one-time transfers

- Set up recurring or future-dated transfers

- View transfer history

To get started:

- Sign on to online banking or the mobile app.

- Navigate to Transfers.

- Select the accounts, enter the date and amount, and confirm.

Bill Pay: A Faster and Safer Way to Pay Bills

From your cable and phone bill to insurance and memberships, save time and stay organized by managing all your payments in one place with Bill Pay.

With Bill Pay, you can:

- Schedule automatic or one-time payments

- View and track your payment history

- Get notifications with important payment updates

- Pay bills at home, at the office, or on the go with our mobile app

How to get started:

- Sign on to online banking or the mobile app.

- Navigate to Bill Pay.

- Set up your payees.

- Schedule your payments.

Managing your finances has never been easier with these digital banking tools. Sign on to Bank Five Nine online banking or download our mobile app to take advantage of these powerful tools today!

Not a customer yet? We’d be thrilled to have you join us! Learn more about what we offer and open an account today!

Recent Comments